Medlin Payroll Professional Edition 2017 Details

Shareware 1.19 MB

Publisher Description

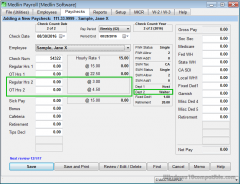

Simple, easy to use, award winning Payroll Software program. Author: Jerry Medlin - Shareware Hall of Fame - Recipient of the FIRST Shareware Industry Award for Best Business and Financial Software. Up to 5000 employees - 941, 940, DE88, DE9, DE9C, NYS-45, W2, and W3 printing - Magnetic Media filing is available - Built in Federal, State, Social Security, and Medicare calculations - Supports: Fixed deductions, Retirement, Section 125, Cafeteria Plans, Tips, Multi-State Payrolls, PTO etc. - Paychecks can be posted into Medlin Accounting.

Simple, easy to use, award winning Payroll Software program. Author: Jerry Medlin - Shareware Hall of Fame - Recipient of the FIRST Shareware Industry Award for Best Business and Financial Software. Up to 5000 employees - 941, 940, DE88, DE9, DE9C, NYS-45, W2, and W3 printing - Magnetic Media filing is available - Built in Federal, State, Social Security, and Medicare calculations - Supports: Fixed deductions, Retirement, Section 125, Cafeteria Plans, Tips, Multi-State Payrolls, PTO etc. - Paychecks can be posted into Medlin Accounting.

Download and use it now: Medlin Payroll Professional Edition

Related Programs

Medlin Payroll

Simple, easy to use, award winning Payroll Software program. Author: Jerry Medlin - Shareware Hall of Fame - Recipient of the FIRST Shareware Industry Award for Best Business and Financial Software. Up to 5000 employees - 941, 940, DE88, DE9,...

- Shareware

- 20 Jul 2015

- 1.05 MB

Medlin Accounting

Simple, easy to use, award winning accounting Software. Author: Jerry Medlin - Shareware Hall of Fame - Recipient of the FIRST Shareware Industry Award for Best Business and Financial Software. PAYROLL: 941 and 940 printing - DE88, DE9, and DE9C...

- Shareware

- 20 Jul 2015

- 834 KB

Medlin Accounts Receivable and Invoicing

Simple, easy to use, Accounts Receivable and Invoicing program. Author: Jerry Medlin - Shareware Hall of Fame - Recipient of the FIRST Shareware Industry Award for Best Business and Financial Software. Up to 10,000 customers - Allows over 30,000 transactions...

- Shareware

- 20 Jul 2015

- 951 KB

Citrus Payroll

Citrus Payroll is a payroll creating and printing program It prints paychecks and stores all data needed for reports It has three options: You can create a separate checking account for payroll (highly recommended) If you have Citrus Checkbook installed,...

- Demo

- 07 Jan 2019

- 3.31 MB

EzWagez Payroll System

Small business payroll system developed using Microsoft's VB.NET technology. Automatically calculates net paycheck amounts using the latest federal income tax tables as provided by the IRS. Calculates Advance Earned Income Credit payments. Computes totals for the quarterly form 941 return...

- Freeware

- 20 Jul 2015

- 32.58 MB